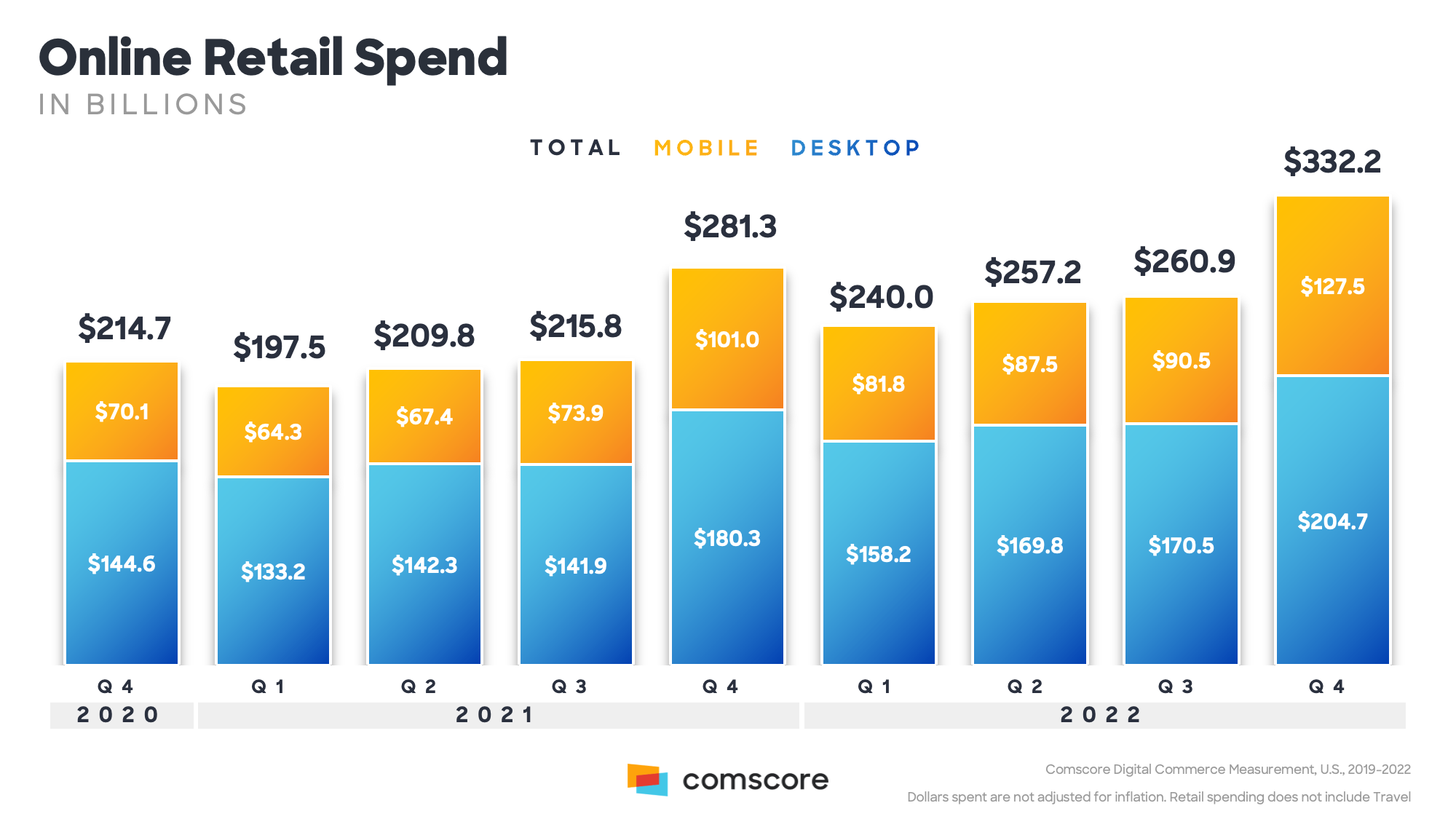

In Q4 2022, according to Comscore, mobile commerce sales set a new record. M-commerce accounted for 38% of the total online sales in Q4 2022, reaching a new all-time high of $127.5 billion.

According to Comscore, this surge can be attributed to a few factors.

Increased Use of Payment Apps

The first factor cited by Comscore is the rise of payment apps from Big Tech, which have made it easier than ever for consumers to complete mobile purchases. Services like Apple Pay, Google Pay, and PayPal have seen increased adoption because they provide convenient and secure payment options for customers. In many cases, these apps have streamlined the checkout process significantly, eliminating the need for customers to manually enter payment and shipping information. With just a few taps, shoppers can complete a transaction.

Social Shopping

The second factor Comscore cited is the increased use of social shopping on platforms like Instagram and TikTok. The integration of shopping features in these social networks has made it that much easier for customers to buy as they scroll the feed, or watch videos. (In fact, Comscore cites the popularity of the “#TikTokMadeMeBuyIt" hashtag, with over 43 billion combined views, as an example of the ubiquity of TikTok and its influence on online shopping.)

These platforms have created a seamless shopping experience for users, allowing them to discover and purchase products without ever leaving the app. For example, on Instagram, U.S. businesses can create in-app Stores, then tag their products in posts and stories, which allows users to click through and purchase items.

Similarly, TikTok has introduced "shopping tabs" on its app. TikTok Shopping allows TikTok users to buy products right in the app, without opening a web browser to visit a separate e-commerce merchant.

What’s Next for Mobile Shopping?

We believe mobile commerce is likely to see further growth, and account for an even larger portion of overall e-commerce sales as financial services companies join the fray, and introduce seamless payment tender capabilities similar to the payment apps.

In the ongoing battle to be “top of wallet,” it’s going to be all about convenience and added value for consumers. The financial services and card issuers are not going to sit idly by while the digital payment apps are increasingly used by consumers. The stakes are high!

How Banks & Card Issuers Are Responding

To capture more mobile commerce transactions away from payment apps like Apple Pay, big banks and credit card issuers are developing a range of capabilities within their own mobile apps and creating innovative partnerships with other companies. Some examples are:

- In-app payments: Banks and credit card issuers are integrating payment functionality directly into their mobile apps, allowing customers to make purchases without leaving the app. This can include integrating with merchants to enable checkout within the app, or using digital debit cards to make payments.

- Loyalty rewards: To encourage customers to use their own apps for mobile commerce transactions, banks and credit card issuers are developing loyalty rewards programs that offer cashback rewards or points for making purchases.

- Enhanced purchase tracking: Mobile apps can provide customers with detailed information about their purchases, including spending analytics, alerts for unusual transactions, and the ability to categorize expenses for budgeting purposes. These features provide more utility, and ultimately help customers become more loyal to the bank/card issuer's app.

- Peer-to-peer payments: Some banks are developing peer-to-peer payment capabilities within their mobile apps, allowing customers to send money to friends and family without needing to use a separate payment app. While this functionality is not necessarily directly related to m-commerce, like #3 above, this feature can help to grow loyalty to the bank/card issuer’s app and therefore away from the Big Tech apps.

- Virtual shopping assistants: Banks and credit card issuers are also experimenting with using artificial intelligence and machine learning to develop virtual shopping assistants within their mobile apps. These assistants can provide personalized recommendations for products and services based on a user's spending habits and preferences, further helping solidify the bank/card's app as a useful helper for the customer.

Overall, the goal of these capabilities is to provide customers with a seamless and convenient shopping experience within the bank or credit card issuer's own mobile app, encouraging them to use their app for mobile commerce transactions rather than the third-party payment apps.

The record-setting Q4 2022 mobile commerce sales is a clear indication that the world of e-commerce is rapidly changing. As more customers adopt digital wallets and as more financial companies introduce innovative payment technologies, mobile commerce will continue to see significant growth in the coming years.