If you haven’t been living under a rock this year, then you’ve heard about how the online shopping landscape is undergoing a rapid transformation on two fronts: 1) how customers conduct product research and buy online, and 2) how they approach spending and budgeting with the help of rewards programs.

For financial institutions and fintechs, adapting to these shifts is critical for maintaining customer engagement and securing payment primacy.

The key is implementing loyalty features that meet customers where they are, whether they are seeking savings or using new technologies (or in this case, both!)

Rewards extend consumers’ budgets

Recent data shows that consumers are already leveraging rewards to manage their budgets strategically. Due to ongoing inflationary pressure and high prices, shoppers are actively using rewards as a subsidy and payment mechanism rather than just an afterthought.

For example, during Black Friday 2025, PYMNTS reported that financially stressed households and younger shoppers leaned heavily into rewards to cover seasonal spending:

- More than one-third of struggling consumers used credit card rewards or loyalty points to cover costs; meanwhile, about 52% of Generation Z shoppers did.

- 49% of customers explicitly chose where to shop based on where rewards delivered the greatest value.

AI as the new product discovery starting point

Simultaneously, the path to purchase is being redefined by artificial intelligence. Generative AI is rapidly becoming a starting point for ecommerce. Shoppers are increasingly relying on AI to decide what to buy, where to buy it, and how to pay:

- CapGemini noted that 71% of consumers want generative AI integrated into their shopping experiences, and 58% are already using AI tools to find product recommendations.

- During Cyber Week 2025, Salesforce reported that AI and agents influenced a whopping 20% of all global orders, translating to $67 billion in sales.

- Adobe Analytics data showed for the full Holiday 2025 period, from Nov. 1 through Dec. 31, 2025, traffic referred to retail sites from generative AI tools increased by 693.4% YoY

Meeting the changing habits of today's shoppers

The upshot for banks? To succeed, they must ensure that their loyalty programs remain relevant, even when product discovery starts on platforms like ChatGPT, Gemini, or Copilot.

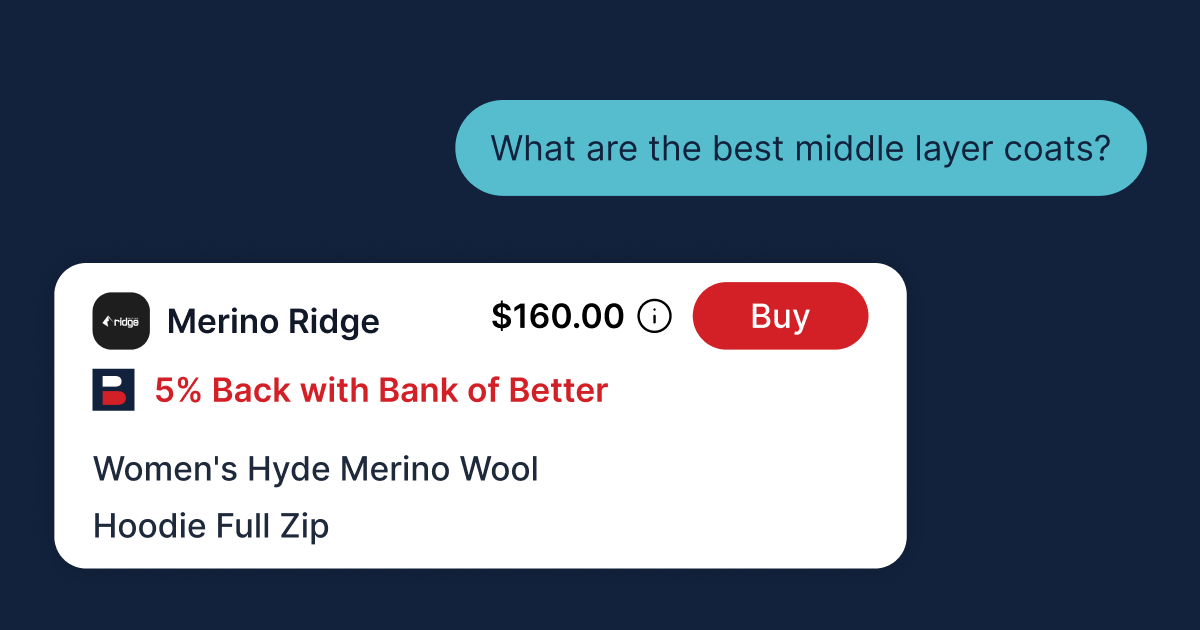

This is where Wildfire’s cashback for AI-assisted shopping feature becomes a critical component of a modern loyalty strategy. Wildfire is the first rewards platform to enable consumers to earn cashback and rewards when they shop through links suggested by AI tools such as ChatGPT, Claude, and Gemini.

Wildfire’s white-label browser extensions can automatically identify product links and available cashback rewards when AI tools surface suggestions.

This ensures that our clients’ banking customers never leave rewards behind, especially as consumer behavior shifts to AI-powered product discovery.

Benefits for consumers and banks alike

By working with Wildfire to offer this feature, financial institutions can:

- Increase engagement and deliver more value to customers: Rewards programs allow consumers to stretch their budgets, helping make spending feel more manageable in an inflationary environment.

- Monetize the new shopping journey: Banks can monetize product recommendations that originate from customers’ AI-assisted shopping and research.

- Stay competitive: With consumers increasingly relying on AI for shopping help, offering cashback on AI-referred purchases will become a requirement for competitive differentiation.

Implementation considerations

Notably, implementing a feature like AI cashback does not require FIs to take on technical debt. Wildfire has already handled the complex backend work, including integrating with over a dozen different affiliate networks, normalizing the wildly disparate data feeds, and meticulously tracking attribution and the entire commission lifecycle. Our client browser extensions automatically include the AI cashback feature.

Future-proofing rewards

By embedding loyalty tools into the digital checkout experience, even when that experience begins with a conversation with an AI chatbot, banks can remain central to the customer shopping journey and deliver value right when the customer needs it, to gain payment preference.

Investing in AI-native rewards is a decisive step toward future-proofing rewards programs and capturing more transaction volume.