In the interest of retaining “wallet primacy” and making sure their card is the first consumers reach for when shopping online, banks and credit card issuers have a strong interest in simplifying the user payment experience at checkout.

Recognizing this, Wildfire now offers Payment Autofill capabilities as part of our white-label cashback rewards browser extensions.

What Is Payment Autofill?

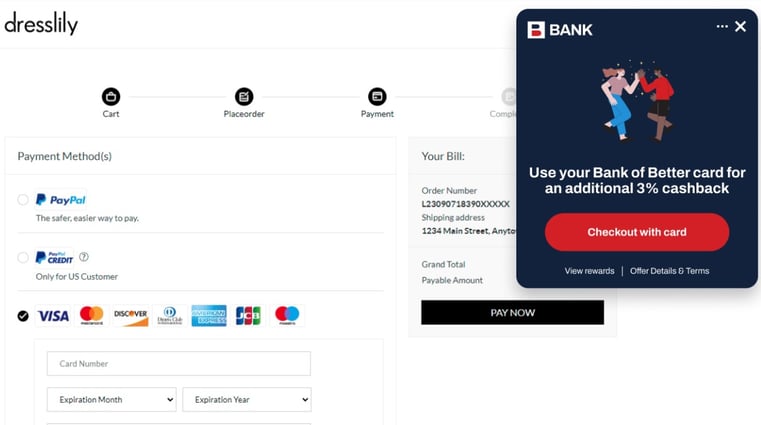

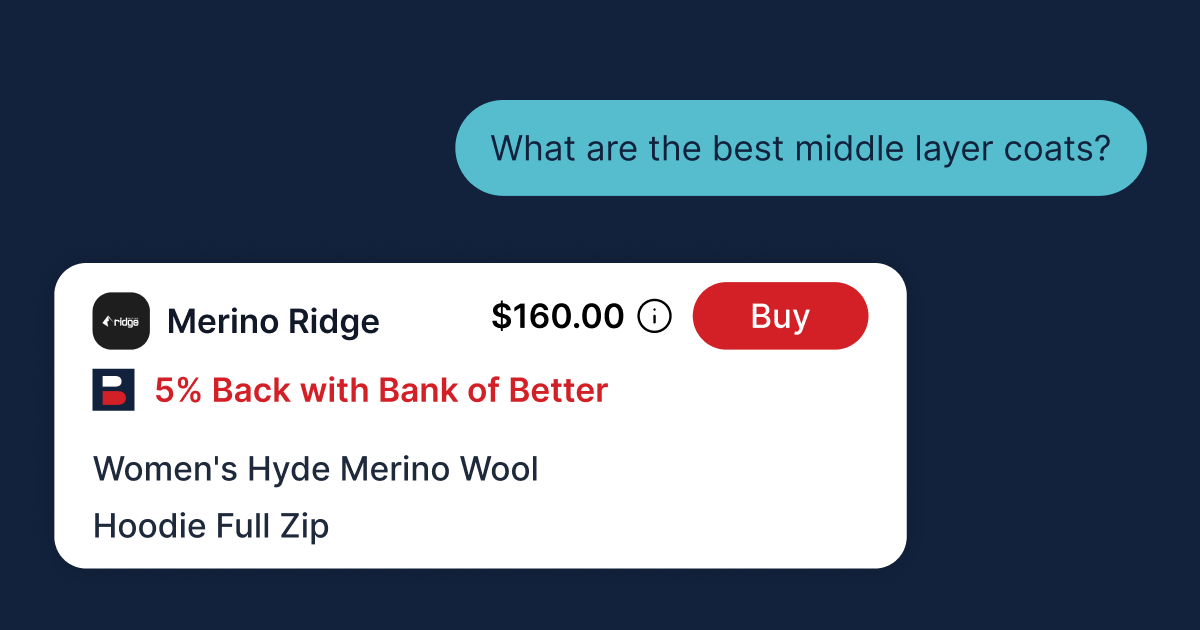

Put simply, Wildfire’s Payment Autofill feature detects when an online shopper is at a merchant’s checkout page and prompts them with a CTA to autofill their payment details for a frictionless checkout experience.

This feature improves the checkout experience for the consumer, but also helps the bank or card issuer - your company - stay competitive with the numerous other payment options during the checkout process such as Apple Pay, or Google Pay.

The average eCommerce cart abandonment rate is 70%. The easiest path is usually the most-chosen path, so if auto-filling with their preferred payment method reduces checkout by even 1 or 2 steps, it’s that much easier for the customer to complete their purchase and continue with their day.

How Wildfire’s Payment Autofill is Different

While users can choose to manually enter any payment card of their choice at checkout, the only payment card options available for Wildfire’s Payment Autofill feature are those associated with your brand. This helps you stay top-of-wallet and encourages users to choose your card every time.

Wildfire’s Payment Autofill feature prompts users to autofill their payment details even before they put their cursor into the credit card field, effectively leapfrogging other payment tenders competing for the customer’s attention.

In addition, Wildfire creates even more incentive for the customer to autofill your payment card by reminding them of the additional rewards they will earn. For example, if your payment card rewards users with 3% cash back already, they will be reminded that they can stack those payment card rewards with those earned from the merchant as a result of the purchase.

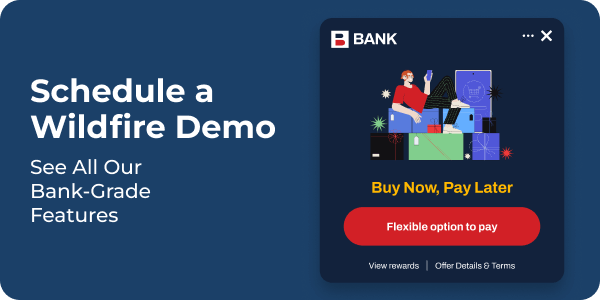

Benefits to the Bank or Card Issuer

Wildfire’s Payment Autofill feature drives tender preference for the bank or card issuer, helping fend off competition from alternative payment types even before the user selects their payment tender. As a result, the bank or card issuer will also enjoy:

- More interchange revenue from consumers using their cards

- Greater wallet primacy at over 1500 online merchants

- Halo effect of positive consumer sentiment through an improved checkout experience

Wildfire follows strict security standards and bank-grade protocols. We never touch any consumer PII and we build to the security needs of our clients.

Benefits to the Bank Customer

Customers utilizing Payment Autofill can save time and money - with the bank’s browser extension, they can stack their credit card rewards with additional shopping rewards they activate & earn.

Benefits to the Merchant

Merchants benefit from Payment Autofill too. By decreasing checkout friction, they enjoy higher conversion rates for customers who shop online with a Wildfire-powered browser extension enabled.

Payment Autofill Creates a Win-Win-Win at Checkout

As consumer expectations grow for an ever-improving online shopping experience, banks and card issuers can benefit from a feature that drives more tender preference & increases share of wallet to help improve interchange revenues. At the same time, Wildfire’s Payment Autofill feature creates convenience and lowers friction for customers who shop online, contributing to positive consumer sentiment and increased loyalty.