The shopping rewards space just got more competitive with the launch of Citi ShopSM, Citi’s new shopping rewards program. This marks the first major product launch in this category by a large US-based financial institution since Capital One Shopping in 2018.

With banks like Citi and RBC now delivering comparable rewards programs of their own, what does this shift mean for other large banks?

For starters, it validates the massive opportunity that exists for revenue generation and customer loyalty in the form of shopping rewards. Banks see shopping rewards programs as a vital part of their retention strategy moving forward. According to a recent whitepaper from the Boston Consulting Group, the old way of engaging consumers, “Loyalty 1.0,” is more transaction-based (e.g. points, miles) and may result in a disjointed customer experience.

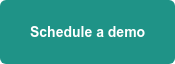

The new way, “Loyalty 2.0,” means adding new loyalty capabilities and removing the barriers to earn and burn loyalty currency, thus delivering more value by engaging consumers seamlessly (for example, when they are shopping online.)

That’s why BCG recommends shopping rewards programs, a core component of Loyalty 2.0, as the right next step for most financial institutions looking to deliver greater customer value and more loyalty.

Creating Retention and Revenue

After the tumultuous economy of 2022 and bank collapses of 2023, consumers flocked to the stability of large, trusted financial institutions. But with high prices and an overall uncertain economic environment continuing into 2024, customers may still consider switching banks to maximize their own value.

As a result, customer retention among large banks has become critically important. Banks are pressed to drive more value, and thus, greater customer loyalty through compelling incentives like rewards programs.

Shopping rewards, in particular, are emerging as a differentiation point that banks can leverage to retain and delight customers.

However, this also sets the bar higher for any rewards platform provider looking to power these programs. Banks have strict standards when it comes to compliance, security, and auditability. They need sophisticated, customizable platforms that can connect to their complex IT ecosystems.

Delivering a Bank-Grade Shopping Rewards Platform

This is where Wildfire excels. Our shopping rewards platform was purpose-built with banks in mind from day one. We’re trusted by some of the largest banking organizations and companies in the world to simplify the complex affiliate ecosystem and streamline the delivery of shopping rewards to their customers. With the largest pool of online shopping rewards offers in the US, our platform drives loyalty, engagement, revenue, and new customer acquisition for our banking partners.

Wildfire has proven itself to be enterprise-grade, or as we like to call it, “bank-grade,” with capabilities such as:

- Flexibility and customization. Wildfire can accommodate bespoke or complex deployments typical of financial institutions, delivering much more security and flexibility than “one-size fits all” solutions.

- Custom reporting capabilities for transparency and audits. We maintain high standards of data quality and provide thorough reporting and auditable transaction logs for our clients’ rewards programs.

- Enhanced security protocols including PCI-DSS and SOC-2. Wildfire is PCI-DSS certified and SOC-2 compliant. And we never touch customer data - we tokenize and anonymize any transaction tracking information but banks ultimately own all their customer information.

- Bank-centric features like pay with points, one-click checkout, and encouraging payment with the banks’ preferred tender. As banks face feature competition, as well as revenue shortfalls due to regulatory changes, we deliver features that help banks stay top-of-wallet, reduce friction at checkout, and compete with alternative payment options.

Shopping Rewards Programs for Banks - What's Next?

The rise of bank-backed shopping rewards programs means more competition. Shopping rewards programs are no longer a nice-to-have; they’re a need-to-have.

The good news is, shopping rewards programs have been proven to add value for banking customers while delivering incremental revenue for financial institutions. This trend also highlights the need for enterprise-grade rewards platforms that meet the strict standards of banks.