Acknowledgements: I owe many thanks to Michael Marcus (Senior Advisor, BCG and Wildfire Board Member) for collaborating with me to expand on the concept of online shopping rewards as a core component of Loyalty 2.0. I would also like to thank the team of authors behind the BCG Whitepaper, “Loyalty 2.0 - Making Loyalty Pay,” for their work in framing this important issue.

Loyalty programs are expensive. If you run a loyalty program today, you are faced with strategic choices about how to enhance the value of the program to meet rising consumer expectations and balance that with ever-increasing costs. It's a hard challenge to solve!

When you step back and try to create options to fund the changes you need to make, we would suggest you focus on a concept pioneered by BCG called loyalty margin. This is defined as:

The benefits that the program offers to customers relative to the cost of those benefits to the company—as well as the incremental expenditure share the program generates and the size of the program.

Most traditional enterprise loyalty programs rely on critical revenue streams to offset/subsidize the program’s costs. But in fact, those revenues typically come from 3 different P&L’s within the enterprise:

- Co-brand credit card program P&L

- Loyalty business P&L

- Advertiser (Merchant) P&L

Traditional Loyalty Program Funding Sources

First, in large co-brand credit card programs, the merchant typically earns a revenue share or profit share from the FI’s credit card program. Success here is defined by growing the size of the card program and attaining primacy in the customer’s wallet related to their everyday spending. You want customers to spend and earn.

Therefore, acquiring new customers, activating them, and engaging them over the long-term is the key to success.

Second, in large airlines, hotel companies, or merchants, there may in fact be a separate loyalty business P&L charged with creating revenue from the sale of the loyalty currency (e.g., miles, points) to loyalty partners (like FI’s). This allows the loyalty partner’s customers to earn and redeem that merchant’s currency as part of their loyalty efforts.

The value of the currency is directly tied to the value of the brand behind it, and the ability to redeem that currency for the flights, hotel rooms, or products the customer aspires to.

Third, there is the core business of the merchant themselves. The retailer generates contribution margins from the sale of their products/services and reinvests those margins in marketing efforts to acquire more customers and retain/engage the ones they have. They think about spending those marketing dollars to optimize their cost to acquire customers and achieve high lifetime values from that customer relationship.

Retail loyalty programs are a marketing expense that are evaluated against all other marketing options.

They must have an ROI.

The opportunity lies in optimizing the loyalty margin from these three P&L’s.

Beyond Traditional Loyalty: The Loyalty 2.0 Puzzle

Today’s loyalty program leaders need to think expansively about how to make the most of these three different P&Ls to drive revenues which fund the expenses of their loyalty programs and expand their loyalty margins. No easy task!

To meaningfully increase the loyalty margin, enterprises must look beyond the traditional loyalty program components. To increase customer incremental revenue, additional loyalty capabilities must be added to the ones already in place.

What if there was a way to inject new, significant incremental revenue sources in the loyalty margin equation and help fund the build-out and enhancement of an existing loyalty program?

This is where shopping rewards programs come in as a core “puzzle-piece” in the next evolution of loyalty - Loyalty 2.0.

>> Read the BCG / Wildfire whitepaper outlining the Loyalty 2.0 concept in detail.

Loyalty 2.0 Components

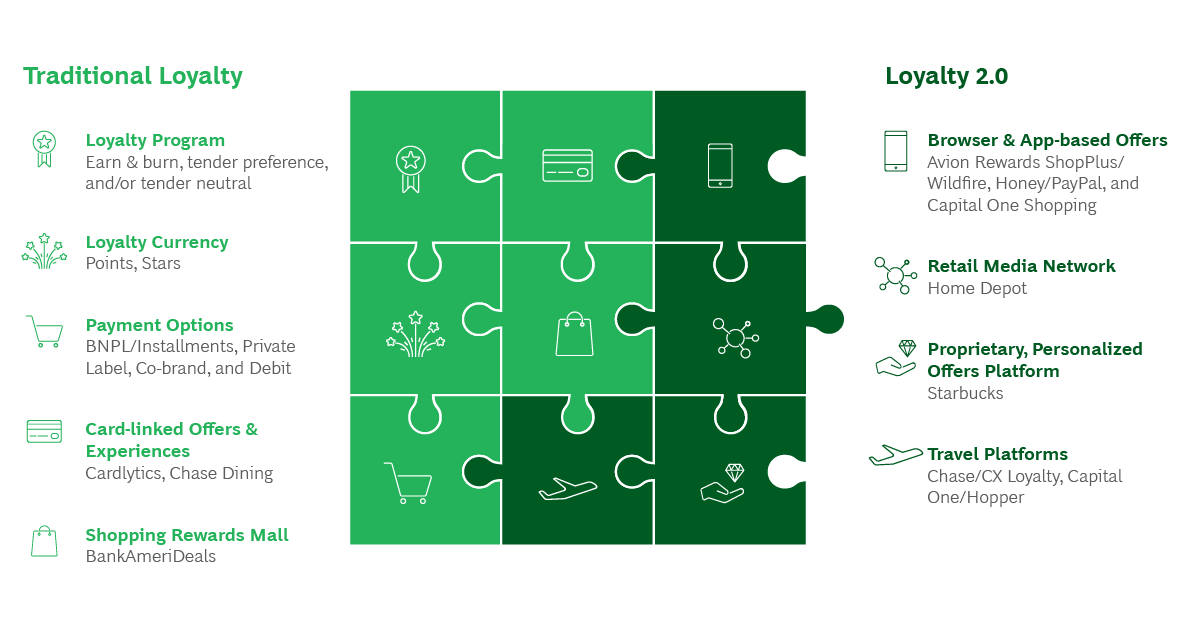

At a high level, the components of Loyalty 2.0 can be both additive and transformative because they remove the hurdles currently required to earn or burn loyalty currencies, while reimagining shopping journeys via a seamless user interface and improved customer experience.

Key pieces of the Loyalty 2.0 puzzle include: travel platforms, retail media networks, proprietary, personalized offers platforms, and finally browser- or app-based shopping rewards programs, which integrate and embed deals and offers in the digital shopping experience.

All of these components have proven effective in creating incremental sales revenue, but we believe offering online shopping rewards programs is the right next step for most programs.

Online Shopping Rewards: A Key Puzzle Piece of Loyalty 2.0

Shopping rewards programs have become a big part of financial services. Capital One broadly advertises its rewards program (Capital One Shopping), and in 2020 PayPal acquired Honey Science Corp. with its suite of money-saving tools, including rebates and a shopping rewards program, to launch PayPal Honey.

Shopping rewards programs delivered through browser extensions and/or apps, integrate and embed deals and offers as the customer shops online, and as BCG outlined, they are an important piece of the Loyalty 2.0 puzzle:

Image credit: BCG

Wildfire's White-Label Shopping Rewards Platform

Wildfire provides an enterprise shopping rewards platform that enables financial institutions and other partners to embed social commerce, rewards, and cashback offerings within their existing digital and mobile services.

The Wildfire platform enables businesses to implement their own white-label shopping rewards program, offering browser extensions, or application programming interfaces (APIs) and JSON feeds.

Wildfire’s flexible shopping rewards technology enables organizations to integrate features within both new and existing applications or rewards programs.

Shopping Rewards Programs Impact All 3 P&Ls to Drive Higher Loyalty Margin

For the co-brand P&L, Wildfire’s shopping rewards platform can promote tender choice directly at the point of purchase after the discounts and coupons have been applied. This allows consumers to stack their co-brand card rewards in a new and unique way. In this example, the card program not only earns the 200 basis points (“bps”) of interchange from the purchase, but also earns the additional ~400 bps of merchant affiliate bounties from the attributable commerce they are driving to the brand from the FI’s shopping extension.

This contributes incremental revenue into the loyalty margin and can enhance the value exchange with the customer to help drive incremental customer tender usage and primacy in the wallet.

For the loyalty program P&L, Wildfire’s technology allows loyalty program managers to reward a customer’s spending in the form of cashback (or loyalty currency of a partner’s choice beyond cashback.) This means if there are more ways to earn the loyalty currency and more ways to spend the loyalty currency, then the loyalty currency itself becomes more valuable.

As more loyalty currency is earned and redeemed, this creates enhanced revenues for the loyalty business’ P&L and enhanced loyalty margin for the loyalty program.

For the merchant P&L, there is also a benefit. As customers are exposed to the merchants’ offers through Wildfire’s browser-based shopping extension capabilities, the conversion rate of that customer’s shopping improves by 8-10x. The more the merchant sells, then the more contribution margin is generated in their core business.

This positively impacts the merchant’s overall P&L, which also creates more revenue to improve the loyalty margin.

Adding this all up, by incorporating a shopping rewards program into a brand’s loyalty capabilities, it creates a win-win-win for FI’s, customers, and advertisers.Across all three P&L’s, online shopping rewards programs create significant incremental revenue to re-invest in the loyalty program and to expand the value exchange with the customer while funding the journey.

Loyalty 2.0: A Win-Win-Win That Pays for Itself

The ultimate win-win-win loyalty program is built by assembling the puzzle pieces of Loyalty 2.0 capabilities to create benefits for the consumer, the financial institution, and the merchant. The consumer gets rewarded, the merchant generates more sales, and the FI earns revenue from the attributable consumer traffic it generates.

The likelihood of using loyalty to shape relationships between consumers and their favored brands has reached a critical point. Cultivating loyal customers is essential for business sustainability and Loyalty 2.0 is the next step in the evolution of how to drive more value from loyalty programs.

We believe that empowering shoppers to find the best deals and automatically applying rewards such as cashback helps drive more revenue for retailers and facilitates a positive brand association for their entire reward chain.

Online shopping rewards programs are the right next step in the Loyalty 2.0 journey to help improve the overall loyalty margin and make loyalty pay (for itself)!